/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

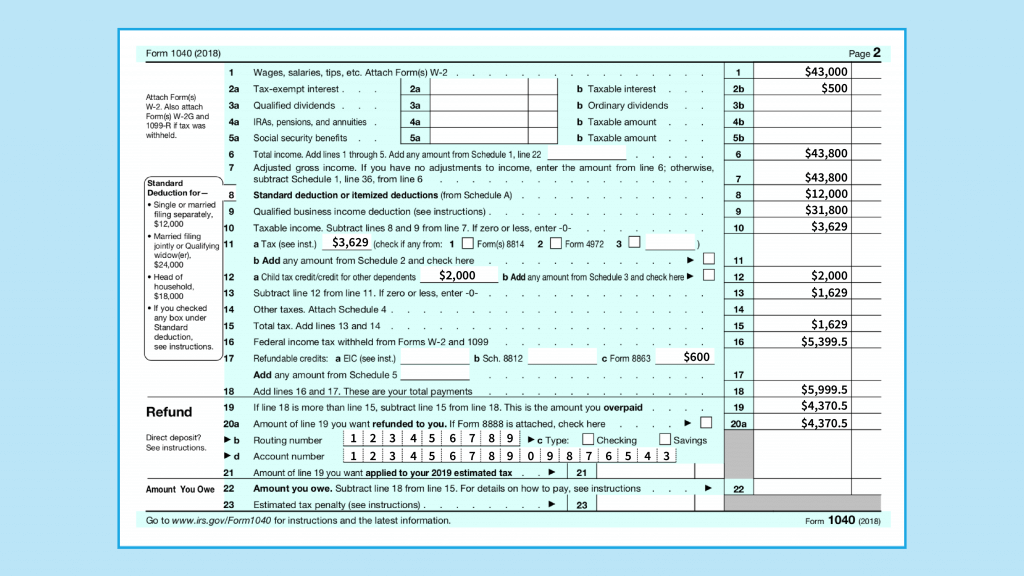

Since you can take the larger of the two deductions, determine if you have eligible expenses to itemize before you settle on a 1040EZ.Ĭommon expenses deductible on Schedule A include mortgage interest payments, real estate taxes, charitable contributions, unreimbursed employee expenses, medical and dental expenditures and state income or sales taxes. Itemizing deductions is beneficial when the total value of your deductions is more than the standard deduction for your filing status.

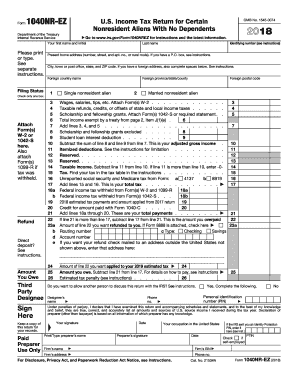

Itemizing deductions is not an option on the 1040EZ form-you must take the standard deduction. You can’t itemize deductions on the 1040EZ Also, if you need to file as married filing separately, the 1040EZ isn’t an option for you. If you have dependents, you should file using the 1040A or 1040 instead. Dependent exemptions are like deductions and can save you a significant amount of money in tax. The head of household and qualifying widow(er) statuses are not available since both require you to claim at least one dependent, which the 1040EZ does not allow.įorfeiting a dependent exemption just so you can save time preparing your taxes isn’t a good idea. The only filing status options on the 1040EZ are single and married filing jointly. It has some limitations that may change the amount of tax you’ll have to pay, or the potential size of your tax refund. The 1040EZ is the shortest of the three, but that does not automatically make it the best one for you.

If you are a citizen or resident of the United States, you can file a tax return on Form 1040, 1040A or 1040EZ. The information below is accurate for tax years prior to 2018 For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. They have been replaced with new 10-SR forms. For tax years beginning 2018, the 1040A and EZ forms are no longer available.

0 kommentar(er)

0 kommentar(er)